Understanding Long-Term Rentals (LTR) in Real Estate: A Comprehensive Guide for Investors and Renters

What Is LTR in Real Estate?

In real estate, LTR stands for Long-Term Rental . This refers to a property leased for an extended period-usually six months or longer, often a year or more. These arrangements are distinct from short-term rentals (STRs), which typically last days or weeks and cater to vacationers or temporary tenants. Instead, LTRs are designed to provide stable housing for individuals, families, or businesses seeking continuity and predictability in their living or operational arrangements [1] , [2] , [5] .

Key Features of Long-Term Rentals

LTRs are defined by several essential characteristics:

- Length of Lease: Most long-term rental agreements last six to twelve months or even longer, with renewals possible after the initial term [2] .

- Stable Income Stream: For landlords and investors, LTRs provide predictable monthly income and typically involve less frequent tenant turnover [3] .

- Lease Terms: Contracts detail responsibilities, rent amount, duration, and potential renewal options, ensuring clarity for both parties [1] .

- Lower Management Demand: Compared to STRs, LTRs require less ongoing management and maintenance due to longer tenancy periods [4] .

Who Benefits from LTRs?

Tenants benefit from LTRs by gaining a stable place to live, predictable monthly costs, and the ability to create a sense of home. This is especially appealing to families, professionals, and students seeking continuity during work or study commitments.

Landlords and Investors enjoy reliable cash flow, easier property management, and reduced vacancy risks. LTRs are often viewed as a lower-risk, lower-effort investment option that provides steady returns over time [3] .

Examples of Long-Term Rentals

Common property types used as LTRs include:

Source: alejandrapizarnik.blogspot.com

- Residential homes

- Apartments

- Townhouses

- Commercial office spaces (typically leased long-term for business operations)

For instance, renting an apartment as a primary residence for a year is a classic example of an LTR agreement [2] .

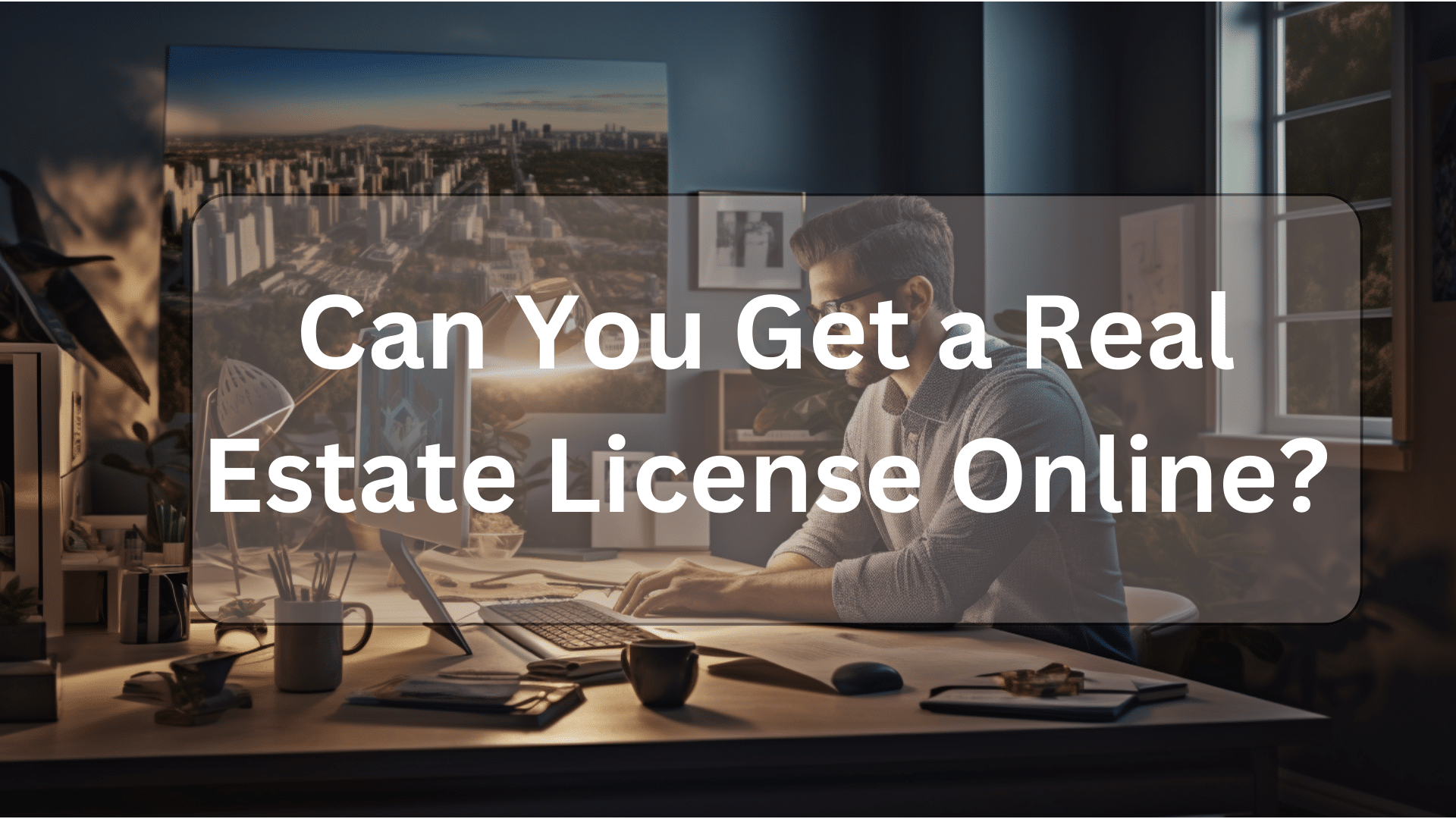

How to Access LTR Opportunities

If you’re interested in becoming a tenant in an LTR:

- Search for rental listings through established real estate portals, property management companies, or local real estate agents.

- Verify the reputation of landlords or agencies by checking online reviews and, if possible, contacting local tenant advocacy organizations.

- Prepare your documentation (proof of income, credit history, references) to streamline your application process.

- Read all lease agreements carefully and seek clarification on any terms before signing.

For investors or landlords considering LTRs:

- Research local market demand for long-term rentals, factoring in population trends, employment rates, and housing supply.

- Consult with licensed real estate agents or property managers who specialize in LTRs for guidance and market insights.

- Consider financing options, such as LTR loans, which offer competitive rates for long-term rental properties. These loans may be accessible based on projected rental income and can sometimes be issued to LLCs, increasing flexibility for investors [5] .

- Screen potential tenants thoroughly to ensure reliability and minimize turnover.

LTR Loans and Financing

Investors seeking to purchase long-term rental properties may consider specialized LTR loans . These loans are tailored for non-owner-occupied investment properties and are often underwritten based on projected rental income rather than personal income. Some lenders offer LTR loans to LLCs or business entities, which can be advantageous for portfolio growth and liability management [5] .

To secure an LTR loan:

- Consult with mortgage brokers or direct lenders specializing in investment property financing.

- Prepare detailed documentation, including a rent-ready property analysis, projected cash flow, and business entity documents if applying through an LLC.

- Review loan terms, interest rates, and qualification requirements. Many lenders offer guidance on eligibility and application steps directly on their official websites.

Potential Challenges and Solutions

LTRs offer stability, but investors and tenants should be aware of potential challenges:

- Tenant Default: Tenants failing to pay rent can disrupt cash flow. Mitigate risk by implementing thorough screening processes and clear lease terms.

- Market Fluctuations: Rental prices may change due to economic trends. Stay informed about local market conditions and adjust rent accordingly if renewing leases.

- Property Maintenance: Long-term use can result in wear and tear. Schedule regular inspections and maintain open communication with tenants to address issues promptly.

Alternative approaches include partnering with property management firms to handle day-to-day operations or utilizing technology platforms for tenant screening and lease management.

LTRs vs. STRs: A Comparison

For investors, the choice between Long-Term Rentals (LTR) and Short-Term Rentals (STR) depends on goals and market conditions. LTRs provide lower risk and more predictable income, while STRs may offer higher returns but require greater management effort and adapt to seasonal demand [1] .

For families and individuals seeking housing, LTRs offer stability and the ability to establish roots in a community, whereas STRs may be suitable for temporary relocation, travel, or flexible living arrangements.

Step-by-Step Guide to Securing an LTR

Whether you are a renter or an investor, follow these steps to engage with LTR opportunities:

- Define your goals-whether stable housing or predictable investment returns.

- Research local rental markets using verified real estate portals and, if available, municipal housing statistics.

- Prepare your application materials or investment documents.

- Contact reputable agencies, property managers, or lenders specializing in long-term rentals.

- Review lease or loan agreements carefully and seek legal advice on any complex terms.

Alternatives and Additional Pathways

If LTRs don’t suit your needs, consider:

- Mid-term rentals (typically one to six months) for transitional or corporate housing needs.

- STRs for flexible, short-duration stays or vacation properties.

- Rent-to-own schemes, where tenants can purchase the property after a period of renting.

Always verify the legitimacy of agencies and lenders through official channels, such as state real estate licensing boards or national mortgage associations.

Key Takeaways

LTR in real estate refers to long-term rental agreements that offer stability, lower risk, and predictable income for both tenants and investors. With thorough market research, careful tenant screening, and proper financing, LTRs can be a foundational strategy for building wealth or securing reliable housing. For more guidance, consult established real estate agents, property managers, or mortgage professionals with experience in long-term rental markets.

Source: letterstotwilight.com

References

- [1] Autohost.ai (2024). LTR vs STR: Pros, Cons, and Insights for Real Estate.

- [2] REtipster (2024). What Is Long-Term Rental (LTR)?

- [3] Privy.pro (2025). Short-Term Rentals vs. Long-Term Rentals-What is The Best Buy and Hold Strategy for Investors?

- [4] Wealth Builders Mortgage Group (2023). STR, MTR, LTR Investment Strategies.

- [5] GO Mortgage (2024). Long Term Rental (LTR).

MORE FROM resultsfordeals.com